Publications Catalog

Financial planning eBooks for US citizens relocating to or residing in Europe

The relocation of U.S. citizens and resident aliens to Europe brings a unique set of complex cross-border financial and tax challenges. Unlike residents of most other countries, Americans are still subject to U.S. worldwide taxation, requiring them to comply with two often conflicting tax systems.

Our comprehensive eBooks are the ultimate guide to navigating the complexities of U.S. expat investing, designed for both DIY investors and investment advisors.

Each guide provides a full roadmap, assisting you:

Understand the Core Conflict: We clarify the clash between U.S. citizenship-based taxation and your host country's residency-based rules.

Overcome Banking Hurdles: Learn the real-world effects of FATCA and PRIIPs on your ability to bank and invest freely.

Master Your Obligations: Get a straightforward breakdown of your duties in both countries, including worldwide income reporting, FBAR, and Form 8938.

Conquer PFICs: Receive an in-depth analysis of the PFIC rules, complete with mitigation strategies like QEF and Mark-to-Market elections. The intersection of US PFIC rules and European investment regulations creates a hostile environment in which ignorance is penalized by wealth confiscation.

Leverage Tax Treaties: Discover how the U.S. treaty prevents double taxation (via Foreign Tax Credits), its crucial impact on pensions, and the limits of the 'savings clause.'

Invest Smarter: Gain practical, synthesized strategies for choosing products (addressing the US vs. non-US fund dilemma), balancing tax efficiency, and structuring your portfolio for growth or retirement.

Investing from the United Kingdom

New 2026 Edition

This eBook outlines comprehensive legislative changes to the UK tax system, primarily through the Finance Act 2025 and official government guidance. Key reforms include the replacement of the traditional domicile-based tax regime with a system centered on long-term residency, affecting how foreign income, gains, and inheritance are treated for individuals and trusts. The sources detail specific adjustments to capital gains tax, corporation tax, and the introduction of a Temporary Repatriation Facility to encourage the movement of overseas capital. Additionally, the texts address complex international tax considerations such as Passive Foreign Investment Company (PFIC) rules for US expats and Social Security Totalization Agreements between the US and UK. Significant updates to inheritance tax reliefs for agricultural and business property are also established, capping full relief at £1 million. These measures represent a broader effort to modernize tax collection, regulate multinational group profits, and refine rules for offshore transfers and employee-ownership trusts. Learn more

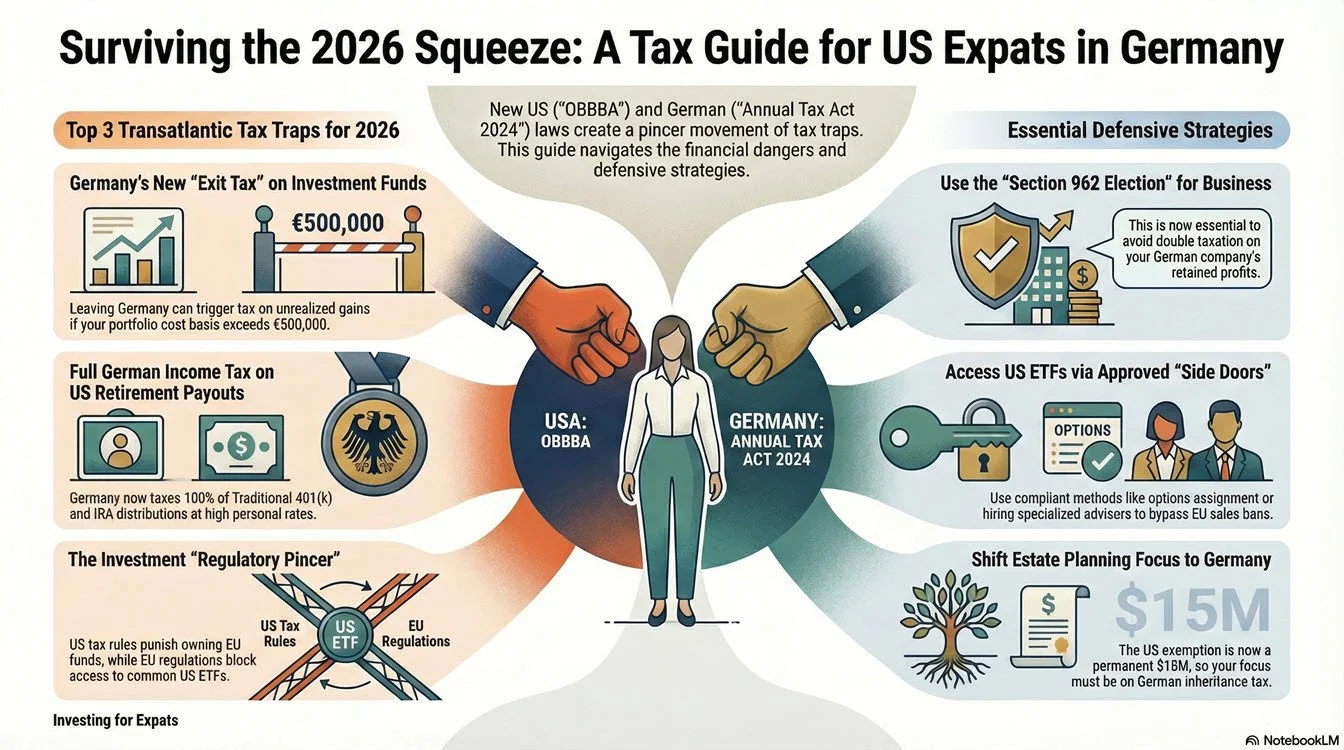

Investing from Germany

New 2026 Edition

These reports outline the highly specialized financial and tax landscape for American citizens residing in Germany for the 2026 fiscal year. They analyze a "pincer movement" of regulatory pressure caused by the American One Big Beautiful Bill Act (OBBBA) and Germany’s Annual Tax Act 2024, which together complicate cross-border wealth management. Key topics include the punitive taxation of foreign investment funds, the loss of tax-advantaged status for US retirement accounts under new German rules, and strategies for navigating conflicting EU and US investment regulations. The sources also detail specific compliance requirements for business owners and the expanded German exit tax on private portfolios. Ultimately, the text serves as a strategic guide for wealth preservation, highlighting the necessity of professional planning to avoid double taxation and liquidity crises. Learn more

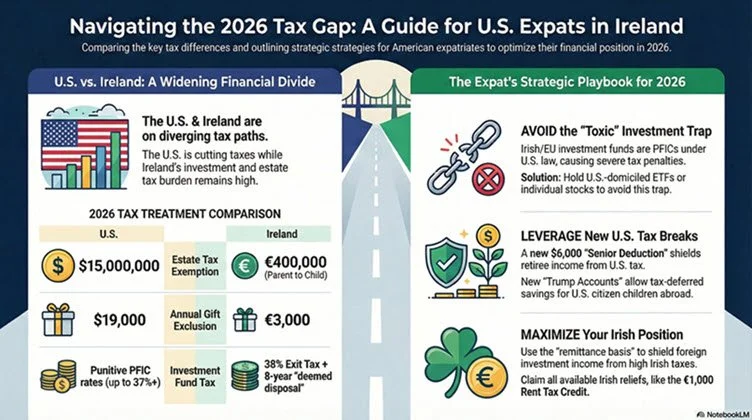

Investing from Ireland

New 2026 Edition

This eBook outlines the major fiscal changes introduced by the One Big Beautiful Bill Act (OBBBA) and Ireland’s Budget 2026, focusing on their impact on U.S. taxpayers and expatriates. Key American reforms include a permanent extension of individual tax rates, significant increases to the standard deduction, and the introduction of a $6,000 senior deduction. New savings vehicles like Trump Accounts are established for children, alongside temporary deductions for tips and overtime pay, though these benefits are often inaccessible to Americans working abroad. In Ireland, the investment exit tax is reduced to 38%, and various rent and social charge adjustments are implemented to address rising living costs. Tax professionals emphasize that U.S. expats in Ireland must navigate the intersection of these laws using Foreign Tax Credits and the Foreign Earned Income Exclusion to avoid double taxation. Overall, the documents serve as a technical guide for managing cross-border wealth, retirement planning, and IRS compliance during a transformative legislative period. Learn more

Relocation planning eBooks

Our guides provide comprehensive relocation planning and advice on every aspect of your move:

Legal & Immigration: Visas, immigration processes, securing legal status, and paths to foreign citizenship.

Finance & Banking: Understanding the financial landscape, taxation, financial compliance, and opening a bank account.

Daily Life & Logistics: Securing accommodation (renting or buying), navigating the healthcare system, and understanding driving regulations.

Work & Culture: Exploring employment opportunities, entrepreneurship, and successful cultural acclimatization.

Other Deep Research reports

FRANCE:

GERMANY:

Strategic Tax & Estate Planning for U.S.-German Dual Citizens Relocating to Germany with U.S. Retirement Assets (Summer 2025, 36 Pages, PDF Format)

Guide to German Residency for United States Citizens: Legal Pathways, Application Procedures, and Strategic Considerations (Summer 2025, 37 Pages, PDF Format)

ITALY:

Not specific to any country: